Employer Pay Stub Obligations

By Jaden Miller , March 18 2025

Employers have certain responsibilities that they are supposed to have for their employees. These are employer pay stubs obligations. They are required by federal and state laws, where non-compliance can result in serious issues. While this can be rather complicated, you can keep it under control.

This article discusses employer pay stub obligations, including federal and state pay stub requirements. You'll also learn about payroll compliance mistakes you should definitely avoid.

What Are Employer Pay Stub Obligations?

Employer pay stub obligations are requirements mainly set up in order to reduce issues in terms of employee payments. An employer is absolutely obligated to pay their employees for their work, which is to be paid duly and accurately.

These obligations are the documents employers are supposed to give their employees. It states their total earnings. The document provides all the basic information. This includes whether or not employee pay stubs will be delivered physically or digitally.

A pay stub helps employees understand their finances. It states all their deductions and calculating taxes. It serves as proof of income when employees need to apply for loans and mortgages. A pay stub also helps to file taxes. This is why employer pay stub obligations need to be followed to protect employees.

What Information Is Required on a Pay Stub?

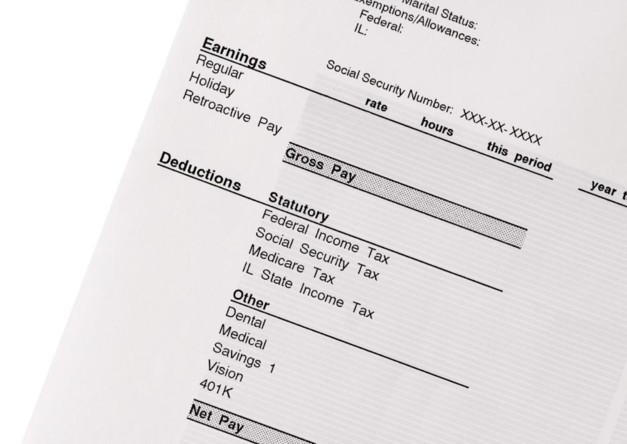

A pay stub is a document that gives details of an employee's salary or wages each pay period. It contains information about their earnings, deductions, and finances. This helps them to budget and manage their finances effectively.

Pay stubs usually contain the following information:

-

Total gross earnings, which is your pay before any deductions

-

Net pay: Your pay after all deductions

-

Dates of the pay period

-

Federal, State, and Local taxes withheld

-

Deductions, including Insurance, Medicare, Social Security

-

Contributions, such as to a retirement or savings plan

-

Total deductions

-

Year-to-date payroll earnings

-

The total number of hours worked: This is usually for hourly workers. It states the different types of hours worked, including regular and overtime, among others.

-

Employees pay rate

Do Employers Have To Provide a Pay Stub?

If you're wondering whether you need to provide pay stubs to employees, well, the answer actually depends. Usually, all employees require pay stubs, but the truth is that not all employers are obligated to provide one.

To fully understand pay stub requirements, you must be aware of the Fair Labor Standard Act (FLSA). This legislation was created to protect employees. It states that employers are expected to keep their employee’s records. They are to maintain correct records of their employees’ work information.

It also doesn't state that this information has to be in the form of a pay stub. However, you need to know if you're expected to provide a pay stub to your employees. This requires taking a look at the federal and state pay stub laws.

Federal Pay Stub Obligations

No federal law currently requires employers to provide pay stubs for their employees. However, employers are expected to provide their employees with their pay information as stated under the FLSA. This act mandates that they properly keep and maintain employee records. Wages must be paid when due, and records of hours worked and pay details must be accessible.

You could create employee pay stubs, but federal law doesn't mandate you to give them to your employees. The IRS also requires that these records must be kept for at least 4 years from when they were filed. Based on certain state pay stub laws, you could be required to keep them for 7 years.

State Pay Stub Requirements

It can be a bit more complicated at the state than at the federal level. This is because employer pay stub obligations depend on the state you're in. They can be grouped into:

-

States with pay stub requirements

There are 26 states that require you as an employer to provide your employees with their pay stubs. They are referred to as access states. You can provide a printed, digital, or written pay stub in these states. This is as long as the employee can view their pay stubs anytime. The states requiring whether employers use any of these depends. However, the states with pay stub requirements include:

-

Alaska

-

Arizona

-

Idaho

-

Illinois

-

Indiana

-

Kansas

-

Kentucky

-

Maryland

-

Michigan

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

North Dakota

-

New Jersey

-

New York

-

Oklahoma

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

Utah

-

Virginia

-

West Virginia

-

Wisconsin

-

Wyoming

-

States with no pay stub requirements

These are states that do not make any provision for employers to create employee pay stubs. They can, however, decide to provide pay stubs, but they are not actually required to do so. There are 9 states with no pay stub laws; they include:

-

Alabama

-

Arkansas

-

Florida

-

Georgia

-

Louisiana

-

Mississippi

-

Ohio

-

South Dakota

-

Tennessee

-

States that require printed or written pay stub format

Some states require employers to provide a pay stub that is either written or printed. They include these 11 states:

-

California

-

Colorado

-

Connecticut

-

Iowa

-

Maine

-

Massachusetts

-

New Mexico

-

North Carolina

-

Texas

-

Vermont

-

Washington

-

Opt-in states

This includes just one state. It requires employers to seek employees' permission before implementing an electronic pay stub. This state is Hawaii. Employers must provide written or printed pay stubs to their employees. They are expected to provide it alongside the details of their employees' pay information. They should do this unless their employees prefer or agree to receive their pay stubs electronically.

-

Opt-out states

Opt-out states allow employees to opt out of receiving electronic pay stubs. Instead, they can receive paper pay stubs from their employer. These states include:

-

Delaware

-

Minnesota

-

Oregon

Payroll Compliance Mistakes To Avoid

It is very common to make any kind of payroll compliance mistakes; rather, they should be avoided at all costs. Non-compliance can result in legal issues. First, check the pay stub you're creating or issuing to see if the details are complete. This may lead to disputes or problems, even during audits. Review your payroll system or employee pay stubs to check for errors.

There might also be situations where employers forget to update their payroll systems. These might be changes in pay stub laws. There can also be minor changes about employees that employers would need to update in their payroll system. This ensures that you're using a recent payroll system to run your business or company.

Pay proper attention and maintain records of your payroll system. Failure to do so can lead to issues. You must keep your employee records for the period of time required by your state. Make sure you maintain a standard procedure when doing so.

Consequences of Non-Compliance

The consequences of non-compliance to pay stub requirements depend on the state in which it happens. They differ by state, and this can lead to fines and legal penalties.

It is also possible that an employer may be audited by the Department of Labor (DOL) or the IRS. This usually happens when the authorities find out that an employer has failed to comply with the law multiple times.

In Summary

While creating a payroll system or simply an employee's pay stub, it is important to follow standard practices. Be sure to be clear and transparent, and make sure all pay statements are easy to understand. Compliance must be maintained by abiding by all local, state, and federal regulations on employer pay stub obligations. Lastly, make it a duty to offer seamless accessibility so employees can access electronic copies of their pay stubs.

Manage your employee pay stubs today with our online pay stub generator. Our tools offer you the best solution to generate accurate and detailed pay stubs as an employer or an employee. Start using our pay stub generator today!Similar Articles

We’ve helped numerous individuals and businesses create professional documents! Create yours today!