Why Do You Need Pay Stubs for Loans and Mortgages?

By Davis Clarkson , March 7 2025

Pay stubs are very important. You need them to apply for loans, mortgages, or credit cards. It has multiple purposes, and in this case, they provide documents that support your income and finances. Pay stubs for loans serve as a form of security, providing evidence of your employment.

Lenders typically require proof of income before giving out loans. While there are various types of loan requirements depending on the kind of loan you want, a pay stub is still required.

By the end of this article, you should be able to understand how pay stubs work for loan applications. You will also learn the requirements to obtain a loan and other documents you can use to do so.

What Are Pay stubs?

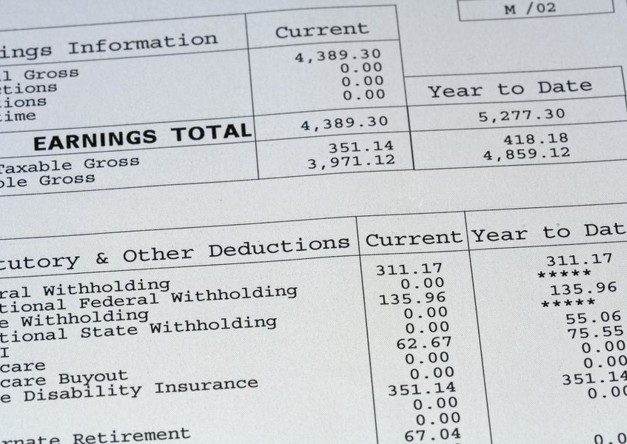

Pay stubs shows details about an employee's earnings and deductions. It includes a summary of their gross and net pay, as well as all deductions over a particular pay period. Employers usually issue a pay stub. It shows the employee's pay rate, gross earnings, taxes taken out, deductions, and net pay. It includes all other relevant information related to an employee.

How Pay Stubs for Loans Works

The first thing lenders consider before giving out a loan is to ensure that you have a stable income. This is where your employee pay stub comes in; it provides a clear explanation of your earnings. They are the most common proof of income that is mostly presented to lenders. They are used to assess whether or not you can pay back the money you're borrowing.

When presenting your pay stub to lenders, it is advisable to give them your recent pay stub. It should be a pay stub for the last two to three months to explain your income stability.

On the other hand, going to the bank to apply for a loan also requires that you still provide your pay stub. This is to serve as proof of income. Banks mostly need to verify customers' proof of income to protect them. It also gives them financial options while they're trying to borrow. In case you're wondering why it's so important to have proof of income, here are a few reasons why:

-

Proof of income helps to calculate your debt-to-income ratio

-

It helps to cover for a low credit score

-

Proves that you will be able to pay back when due

-

Proof of income can help you lower your interest rate

-

It explains your financial status

Proof of income also works when you're trying to apply for a mortgage or car loan or when opening a new bank account. Pay stubs are key mortgage approval documents. You need one when applying for a mortgage.

Requirements for a Loan

Loan requirements can vary based on the loan type and lender. These requirements are used to check if you'll be able to repay the loan; they include:

-

Income: This proves that what you earn is enough to repay the amount you want to borrow. They'll need to know your financial capacity and know if your income is stable.

-

Credit Score: A credit score rates how trustworthy you are with borrowing. It reflects your past borrowing habits. It predicts your total credit behaviour and ranges from 300-850. It helps lenders determine how likely you are to pay back, and it is affected by different factors. These factors are unpaid debts, existing debts, bill payment history, and the number of credit and bank accounts. If your credit score is high, you have a better chance of securing the loan than if the score is low.

-

Debt-to-Income Ratio: The DTI ratio shows what portion of your monthly income goes to debt. You usually get this number by dividing your monthly debt payments by your monthly gross income. If your DTI ratio is below 43%, you are financially qualified to take on a new loan. It assures lenders that you can consistently pay back your loan.

-

Collateral: Most loans usually require collateral. A collateral refers to any asset that you could use to hold or guarantee your loan. Mortgages and auto loans usually need collateral. This collateral serves as security for the loan.

-

Origination Fees: An origination fee is used to pay the expenses that the lender uses to review the borrower's credit history. It also includes the costs to process their loan application. An origination fee is not required for all loans. However, when it is required, you can pay up to 1% to 8% of the total loan amount.

How To Obtain Pay Stubs for Loan Application

Whether you're an employee, an independent contractor or a freelancer, this process can be different for you. If you are an employee, your pay stub will be issued to you by your employer. You must ensure that you track and review your pay stub regularly. This is to make sure that there are no errors on your document and that you're on top of your finances. Store your pay stub in a safe place, whether you're storing it digitally or physically.

Freelancers or independent contractors are responsible for keeping track of their financial records. As one, it means that you're in control of your income; therefore, you have to create your pay stub yourself. You have to be careful while creating your pay stub because of errors and discrepancies.

For both employees and freelancers, it is much easier to use pay stub software. These online tools make pay stubs that are accurate and error-free. They help you track your finances easily. Just enter your job details and tax info. The pay stub generator will create your pay stub right away.

Other Proof of Income Verification Documents

It can be interesting to note that a pay stub is not the only document you can use to apply for loans. Knowing how these documents work can help you get ready for the application process. These documents include:

-

W-2

W-2s show an employee's long-term earning potential, unlike pay stubs. A W-2 form is a document an employer sends to each employee and the IRS. It shows the income from an employer and the taxes taken from an employee's paycheck. This is so that taxpayers can file federal and state taxes. Some lenders ask for W-2 forms during the application process because they provide broad information about the borrower's annual income.

-

Bank Statements

A bank statement can also serve as proof of income. It may be requested instead of a pay stub when applying for a loan. It shows a person's financial transactions from the last two to three months. Lenders use your bank statement to check your finances. Then, they decide if you qualify for the loan.

-

Tax Returns

Tax returns help verify income. Lenders often ask for them to prove earnings. This document is used to explain your earnings over the past year to the lender. It usually has details about your income, deductions, and taxes you owe. For many borrowers, tax returns are a good sign of their financial health. Usually, lenders ask for tax returns from the last two years to check your income consistency.

-

Employment Verification Letter

An employment verification letter is proof of income when applying for a bank loan. It shows that you are truly employed, confirming how long you've been working for. It also shows your salary or hourly wage and other information. You need to show this document to lenders to verify your employment. You can simply contact your employer or HR department to request this document.

Bottom Line

It can be really easy to apply for a loan once you have all your documents ready. Once it's complete, accurate, and follows all necessary requirements, your chances of approval are increased. You also get to experience a stress-free and smooth application process. So, it's a good idea to keep your pay stubs and other important documents safe. Also, check them regularly. This then ensures better security for them.

Our Paystub Generator makes it extremely simple to generate your pay stub. Our tool is an online software that saves you time and effort by creating your document in seconds! It is efficient and reliable, so try using our pay stub generator.

Similar Articles

We’ve helped numerous individuals and businesses create professional documents! Create yours today!